OBBBA Consequences Cited in New Trust Fund Insolvency Warning - Investopedia; AMAC

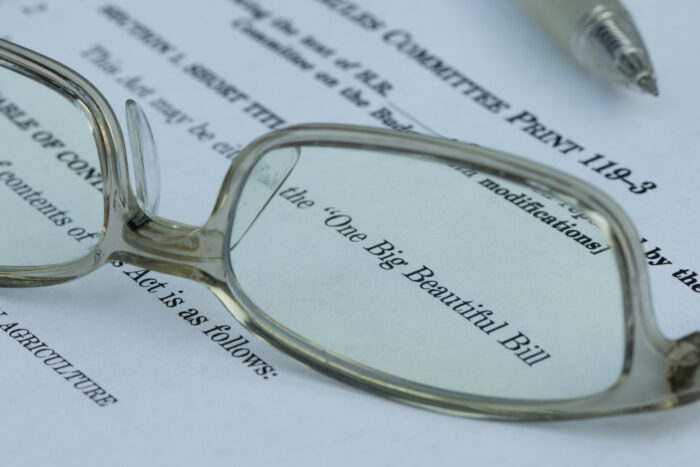

The 2026 tax filing season kicked off officially earlier this week, and many taxpayers are eagerly awaiting an assessment of the impact on their personal financial situations. Larger refunds, or at least lower tax liabilities, are likely in store for many filers…that’s the upside to the One Big Beautiful Bill Act signed into law last July. Amid the handclapping, though, there’s a bit of hand-wringing, especially by those tuned into Social Security’s steadily worsening financial picture.

In a post yesterday on Investopedia, personal finance reporter Elizabeth Guevara outlines the “serious tax savings” ahead for filers, while balancing the euphoria with a glance at how the OBBBA changes “cut into Social Security funding.” Those who follow the details associated with Social Security’s financial problems know that the taxation of benefits is a fairly substantial chunk of the program’s revenue stream…$55.1 billion in 2024. Sure, that’s a relatively small portion of the program’s revenue that year (about 4%), but since Social Security has been operating in deficit mode for the past five years, and since this deficit is projected to grow steadily and significantly for the next six or seven years, ending in insolvency by 2032 or 2033, it’s still a cause for alarm. In fact, any factor that increases the hole size must be accounted for in the urgency of finding a solution to the long-term problem.

Why This Really Matters

In addition to explaining OBBBA’s Social Security revenue implications, Ms. Guevara puts the issue in clear perspective with this comment: “The reserves funding Social Security benefits continue to dwindle, and lawmakers are taking little action to resolve the issues. This could result in fewer benefits for retirees and those with disabilities. If benefits are cut, the majority of the almost 75 million beneficiaries say they won’t be able to survive financially.”

Not a comforting observation, for sure, but there is time for Congress to take action to address the insolvency issue. Many organizations have long contributed suggestions to modify various sections of the Social Security program to extend its life, but time is clearly running out. One such slate of proposed solutions is available on the Association of Mature Americans’ (AMAC) website, in its Social Security Guarantee, a 15-point plan based on common-sense solutions to stabilize the program’s finances for generations to come. Importantly, AMAC’s plan seeks to adjust the program from within, without raising payroll taxes on the American workforce.

What You Can Do

What’s really needed at this point is for all affected parties (and that’s really everyone) to express concerns about this looming catastrophe to their congressional representatives in the House and the Senate and urge near-term action. It’s not a self-correcting problem!