Billionaire’s Tax, Independent Voters, and Social Security - AMAC & RealClearPolitics

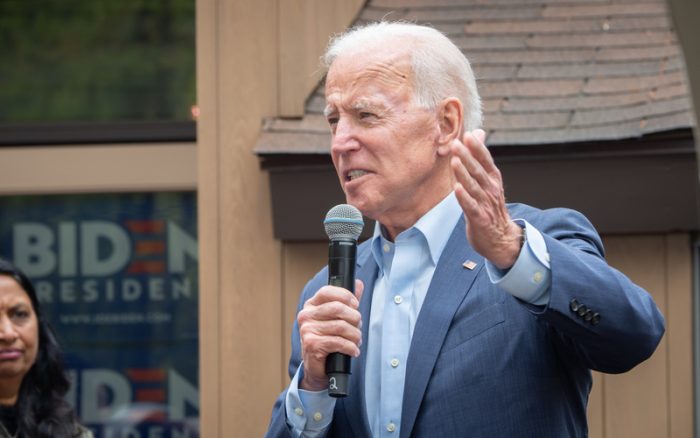

Phillip Wegmann looks at the current state of politics and Social Security. It’s an issue that Democrats normally have in their back pockets, but Independent voters are evenly divided on whom they trust on the topic in 2024. Both Biden and Trump have pledged “hands off” even as the program barrels toward insolvency. But progressives brought some polling data to Biden in January, and they want the messaging to be, “President Biden and Democrats want to increase taxes on billionaires and protect Social Security from cuts.” That message puts Biden ahead of Trump with Independents. Read the full piece here.

As an example of the leading thoughts on reforming Social Security, the Association of Mature American Citizens (AMAC, Inc.) believes Social Security must be preserved and modernized. This can be achieved without tax increases by slight modifications to cost of living adjustments and payments to high income beneficiaries plus gradually increasing the full (but not early) retirement age. AMAC Action, AMAC’s advocacy arm, supports an increase in the threshold where benefits are taxed and then indexing for inflation, and calls for eliminating the reduction in people’s benefits for those choosing to work before full retirement age. AMAC is resolute in its mission that Social Security be preserved for current and successive generations and has gotten the attention of lawmakers in D.C., meeting with many congressional offices and staff over the past decade.