Social Security’s Rumored Demise - AMAC Foundation

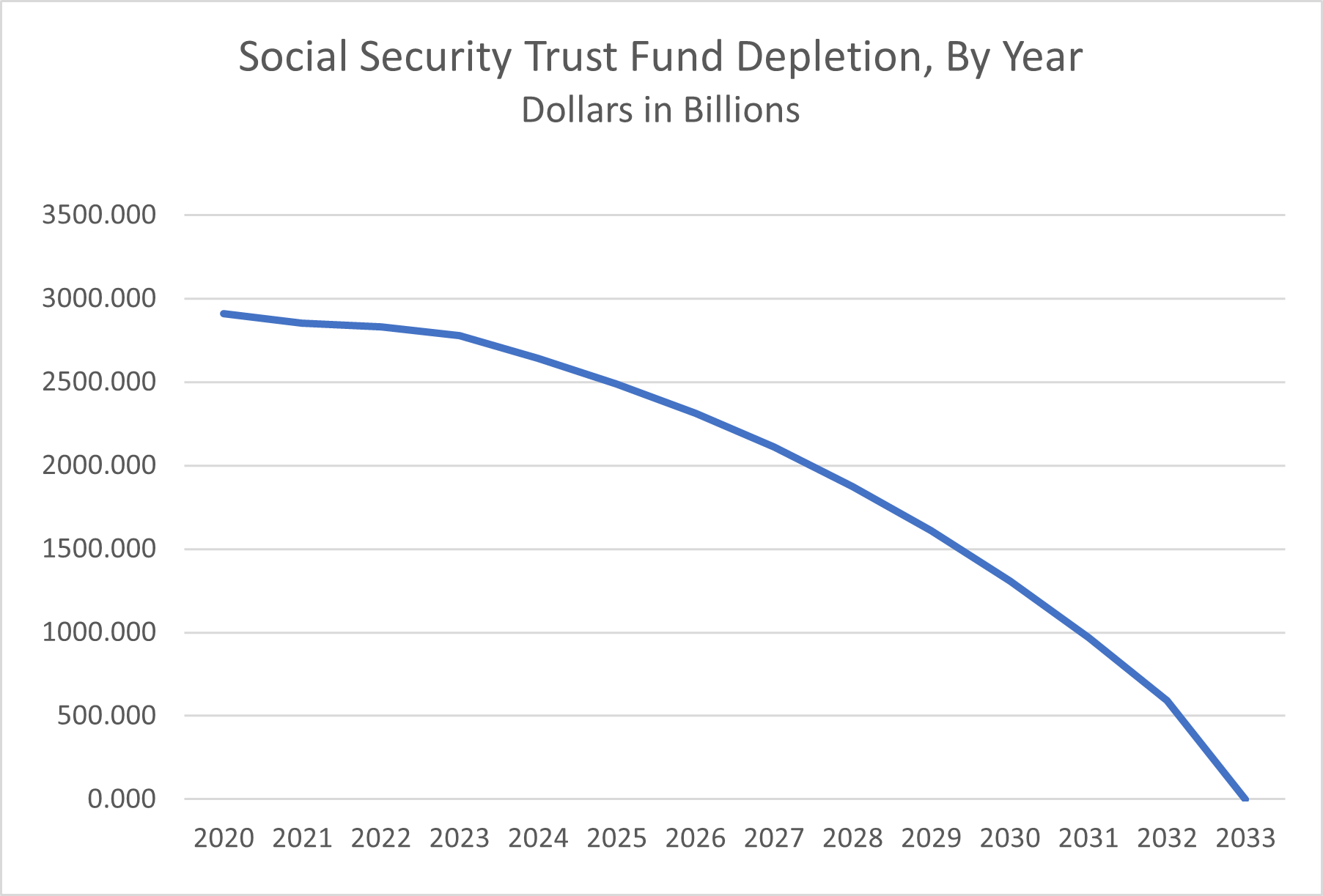

“Social Security benefits will end in about a decade.” This is an ongoing, frequently reported rumor that indicates misunderstanding about how Social Security is financed. The reality is that Social Security’s trust fund reserves have, since 2021, been used to fully honor the program’s benefit commitments. This is because payroll tax revenue—the primary source of income to pay benefits—has become insufficient to meet scheduled benefits. The trust fund balances had reached a high point of almost $3 trillion prior to 2021 as the system took in—from all sources, and that includes interest on its reserves, income taxes on benefits paid, and payroll taxes—more than it paid out.

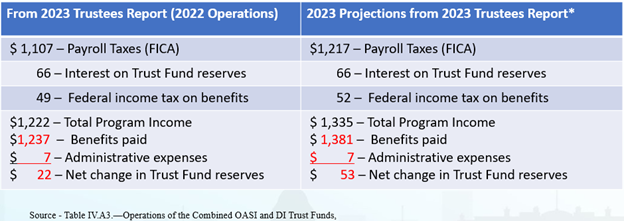

Here’s a quick look at how Social Security is funded. Note that last year, the program had incoming revenue of $1.2 trillion, and paid out more than that in benefits and operating expense…$22 billion more.

This deficit is projected to grow to $53 billion in 2023 and then continue to grow until the reserves are completely exhausted. This chart shows the projected timeline for the use of Social Security’s reserves, and you can readily see the year-by-year drop in these reserves.

There are several basic reasons for the projected insolvency, notably the longer life spans enjoyed by retirees, a steady drop in the ratio of payroll taxpayers to beneficiaries–a ratio that was as high as 42 to 1 in the mid-1940s and is now well less than 3 to 1 now–and a change in workforce earnings patterns that shifted a larger portion of earnings above the maximum taxable earnings limit. This latter point simply means that more of the country’s total workforce payroll exceeded the limit at which FICA tax is imposed than projected decades ago.

So, the use of trust fund reserves is projected to continue until the balances reach zero, with some sources—notably the Congressional Budget Office—projecting that to occur as early as 2032. At that point, by law, Social Security would then revert to a cash basis, with outlays matching revenue coming into the system. Benefits would need to be cut across the board by an estimated 20 to 25 percent, but would continue to be paid using incoming payroll tax revenue.

Avoiding the across-the-board benefit cut will require Congressional action, just as was the case the last time Social Security reached the brink of insolvency…that was 1983, when Congress implemented the Budget Reconciliation Act that brought changes like a setback in the full retirement age and federal income tax on Social Security benefits.

The insolvency predicament is gradually gaining attention in Congress, and will likely be a key point in the 2024 presidential election campaigns. Realistically, all expectations are that Congress will at some point wake up to the problem and enact legislation to restore the program to pay full benefits as promised. Many solutions have been proposed, some involving tax increases, some calling for changes in the benefit calculations, but the prevalent mindset is that the eventual solution will be a combination of the two. No matter what, the longer corrective action is delayed, the more disruptive the changes are likely to be.