The One Big Beautiful Bill Is Now the Law of the Land - AMAC Foundation, et al.

The victory laps are underway, the pre-passage performance politics have ended, and the dust is settling on H.R. 1, “The One Big, Beautiful Bill Act.” Now, in the aftermath of President Trump’s Independence Day signing of this historic legislation, America’s seniors are anxious to learn the impact on their financial situation, at least for the next four years.

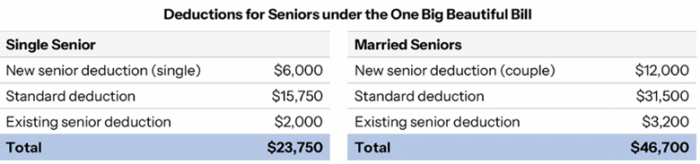

Here’s what we know: the text of the Bill forwarded to the President included this directive: “In the case of a taxable year beginning before January 1, 2029, there shall be allowed a deduction in an amount equal to $6,000 for each qualified individual with respect to the taxpayer.” This “bonus” deduction will be in addition to the enhanced standard deduction and existing senior deduction amounts made available via H.R. 1’s extension of the 2017 tax cuts. To make it clearer, let’s put it into dollars using a chart featured in a communication directly from The White House:

Both the Standard Deduction and the additional Senior Deduction will continue to be indexed for inflation.

Looking back to the 2024 tax year (returns filed in 2025), these new deductions represent increases of 40% for single filers age 65 and older, and 26% for married couples filing jointly (if both are age 65 or older). With these increased deductions in place, the Trump Administration estimates that 88% of tax filers age 65 and older will, in effect, be relieved of a federal tax burden on their Social Security benefits.

What If You’re Not Claiming Social Security Benefits?

H.R. 1 actually doesn’t specifically discuss Social Security benefits. The reconciliation “workaround” developed by Congress creates a bonus standard deduction for filers age 65 and older. In other words, the H.R. 1 change relates to the standard deduction bonus in general, with no specification as to what types of income comprise one’s adjusted gross income.

In the context of this Bill, the “bonus” standard deduction does not require that tax filers actually receive Social Security benefits, nor does it require that they be eligible for Social Security benefits. While the end result of the additional deduction is a lesser degree of taxation for filers age 65 or older, it literally has nothing to do with Social Security per se.

For Social Security Beneficiaries Not Yet Age 65

Both the House and Senate versions of H.R. 1, in crafting the increased standard deduction provision, have defined the term “senior” as age 65 and over. This is consistent with the IRS definition of “senior,” and continues the definition used in the Tax Cuts and Jobs Act of 2017.

So, to qualify for the new $6000 senior deduction, IRS rules state: “You’re allowed an additional deduction if you’re age 65 or older at the end of the tax year.” Also, consistent with Social Security rules, you’re considered to be 65 on the day before your 65th birthday.

Some Other Points to Keep in Mind Regarding the “Bonus” Deduction

It’s Temporary

Repeating part of the bill text shown earlier, the additional $6000 deduction is applicable to tax years “… beginning before January 1, 2029…” In other words, the bill proposes the sunset of the bonus deduction at the end of the 2028 tax year. What will happen after that is anybody’s guess, but keep in mind that the enhanced deductions originally set forth in the Tax Cuts and Jobs Act of 2017, including provisions for their indexing, have been made permanent by the “One Big Beautiful Bill Act.”

It actually has nothing to do with Social Security

As discussed above, the One Big Beautiful Bill Act doesn’t specifically discuss Social Security benefits. Since the change relates only to the standard deduction portion of a tax return, the filer does not need to be a Social Security beneficiary or even eligible for Social Security benefits. The “bonus” is strictly related to deductions from taxable income.

Also, remember that the $6000 “bonus” deduction is applied on an individual taxpayer basis. If, in the case of a married couple filing jointly and one is not age 65 or older, the total additional deduction is only available to one of the filers.

There is an Income-Based Phaseout for the “Bonus”

The full “bonus’ deduction is available up to a modified adjusted gross income (MAGI) of $75,000 for single filers, $150,000 for married couples filing jointly. The “bonus” deduction amount begins to gradually reduce at those points, phasing out completely at $175,000 for single filers and $250,000 for married couples filing jointly.

H.R. 1 Does Not Address Social Security’s Long-Term Financing Problem

In fact, as in the case of the revenue impact of H.R. 82 (The Social Security Fairness Act), H.R. 1’s deduction provision has the potential to further accelerate the program’s projected insolvency date. The Committee for a Responsible Federal Budget (CRFB), in a June 27 blog post, projects a $30 billion decrease in revenue from benefit taxation, resulting in a corresponding acceleration of the Old-Age and Survivors (OASI) trust fund depletion from early 2033 to late 2032. Further, CRFB projects a deeper benefit cut resulting from full trust fund depletion, from 23% to 24%.

So, despite much-appreciated temporary tax relief for seniors, the Social Security insolvency problem is not going away. With less than seven years of runway, the pressure on Congress to craft a workable solution to the program’s long-term financing problem will intensify. As everyone knows, the closer we are to the endpoint, the more severe the consequences will be. CRFB’s Maya MacGuineas, in a post yesterday on dallasnews.com, puts the problem in perspective with this comment, “Pretending there’s not a problem won’t make it go away.”

Was there anything in the in The Big Beautiful Bill that would prevent Congress from borrowing from the Social Security Trust Fund? I really do not understand how this was ever permitted.

Hi Sybil,

Thank your for your question about the “one big, beautiful bill” (OBBB) recently enacted by President Trump. To answer your question, the OBBB did not address Congress borrowing money from the Social Security Trust Fund because it is/was not necessary to do that. I’ve written on this topic numerous times – that the government has not “stolen” any money from Social Security. When SS was set up by FDR in 1935, it was mandated that all money collected for SS was invested in “special issue government bonds” which pay interest to SS. And that is how the program has always worked and still does. As of the end of 2024, there were about $2.7 trillion dollars in the SS Trust Funds, which are redeemed whenever needed to pay Social Security benefits. But no Social Security money was ever used by any politician for any other purpose, and money in the SS Trust Funds can only, by law, be used for Social Security purposes.

Technically, when SS money is invested in those Government Bonds, the actual cash goes into the U.S. Treasury, just like it would if any individual bought government bonds. But these “special government bonds” for Social Security are redeemable at any time as needed, so the Government repays the SS Trust Fund every day as bond are redeemed as needed to pay benefits to SS recipients. So, Sybil, I hope this answers your question, but please feel free to contact us at SSadvisor@amacfoundation.org if you have further questions.

Regards,

Russell Gloor

Certified Social Security Advisor

The AMAC Foundation

My only income is from so sec. I get $1100 a month. Are there any plans for extra money for below poverty seniors?

Cheryl:

Thank you for the comment and question. If the $1100 monthly earnings you noted are your only source of income, the One Big Beautiful Bill Act provides no additional benefit that would apply to you. This is because you are already exempt from federal income tax on your benefits, and the additional deduction bonus is not structured as a refundable credit. Although your income level is above the monthly federal benefit rate for Supplemental Security Income, you might want to check with your state agencies. The USA.gov/benefits website provides an index that can help you search for assistance available in your state. That service can be found here: https://www.usa.gov/state-social-services.

Gerry Hafer

AMAC Foundation Social Security Advisor

The above is intended for information purposes only and does not represent legal or financial guidance. It presents the opinions and interpretations of the AMAC Foundation’s staff, trained and accredited by the National Social Security Association (NSSA). NSSA and the AMAC Foundation and its staff are not affiliated with or endorsed by the Social Security Administration or any other governmental entity. To submit a question, visit our website (amacfoundation.org/programs/social-security-advisory) or email us at ssadvisor@amacfoundation.org