Warning: Retirees Are Likely to Continue Losing Ground to Inflation - The Motley Fool; AMAC

You’ve probably seen the reports stating that seniors have lost considerable ground to inflation since 2000. If you’re a retiree living on Social Security benefits, you’re well aware of the cost increases that have outstripped your income for some time, but even more dramatically in recent years. The Senior Citizens League (TSCL), for example, has gone on record with this statement: “Social Security Benefits Lose 36% Of Buying Power Since 2000.”

While Social Security’s inability to keep pace with inflation, at least specifically in many of the cost categories common to seniors, is well known, it’s likely that the program’s steadily worsening financial condition will not allow for process improvements any time soon. That’s the theme of a post by The Motley Fool’s Christy Bieber, wherein she explains the current cost-of-living adjustment (COLA) process and how present conditions are likely to blunt attempts to address it. Read her post here.

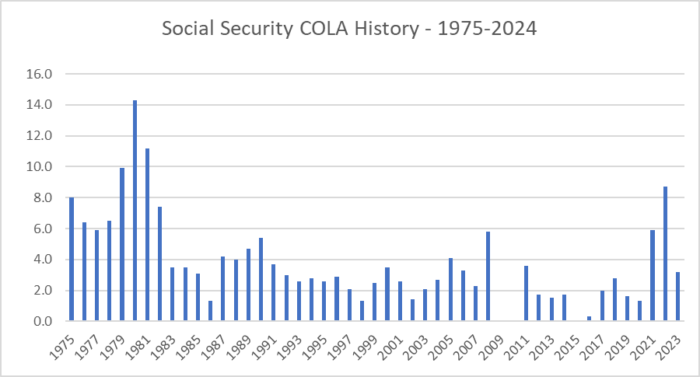

The COLA process itself has been the source of quite a bit of commentary through the years. The size of the adjustment fluctuates with economic cycles, and has ranged from a high of 14.3 percent in 1980 to 0.3% in 2017 (excluding, of course, the zero years). Here’s a historical look-see at how the adjustments occurred since 1974, just to show you the cycles in action. The historical average for these 49 years, incidentally, was 3.8 percent, so the 2024 adjustment of 3.2% wasn’t that far from the average.

Congressional bills have been introduced to improve the COLA process, but to-date change has been elusive. Most recently, the Boosting Benefits and COLAs for Seniors Act (S. 3974) is representative of attempts to achieve a formula for beneficial for seniors.