A Deeper Dive Into the Increased Full Retirement Age Question - Kiplinger; AMAC Foundation

The Social Security system’s steadily eroding financial picture is becoming more noticeable in the media these days, especially since approval of the “Social Security Fairness Act” deepened the hole. It’s not new news, of course, but we’re beginning to see more attention focused on steps that could be considered to ward off the projected across-the-board benefit cuts now projected to hit in about eight years. By the way, that’s not a lot of time to craft solutions that would avoid massive disruption to the retirement plans for future retirees.

One of the “solutions” regularly surfacing in the quest for a pathway to stabilizing Social Security’s long-term finances is the thought of raising the full retirement age (FRA), or “normal” retirement age (NRA) in Social Security parlance, beyond the current 67 (for those born in 1960 or later). Kiplinger retirement writer Donna Fuscaldo examines one such approach in a post today on their website, providing a perspective on the inevitability of such a move and its implications for future generations. Her analysis notes the Congressional Budget Office (CBO) perspective that a change to an FRA of 69 would not stave off insolvency in the near term, although it would improve the program’s long-term (75-year) projection period. Read Ms. Fuscaldo’s full post here.

Some Additional Background on the Issue

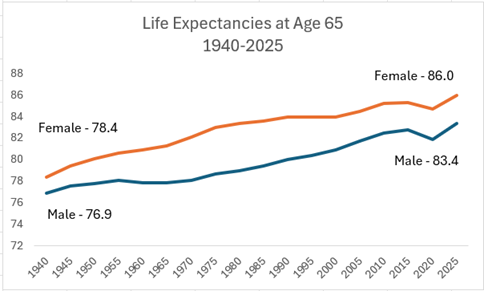

For background, the Social Security insolvency problem relates to the depletion of trust fund cash reserves and can be attributed to several key factors. One such key is the length of time benefits need to be paid to beneficiaries. For example, since 1940 life expectancy for those reaching age 65 has grown substantially, increasing by 9.7% for females and 8.5% for males, a trend expected to continue rising through the end of the century.

Source – 2024 Social Security Trustees Report, Table VA4. https://www.ssa.gov/OACT/tr/2024/V_A_demo.html#226697

The fact that American seniors are living longer is indeed a positive societal development, but it presents a challenge to ensuring long-term Social Security solvency. In addition to longer life-expectancy, the “Baby Boomer” generation has been reaching retirement age since 2008. This population cohort is uncharacteristically large—76 million—and is expected to result in roughly doubling the population of Americans over age 65 by 2031.[1] By one estimate, 75% of these retiring “boomers” will begin drawing benefits at the earliest eligible age, 62, with many of them leaving the workforce entirely. [2] This is anticipated to create additional pressure on Social Security’s cash flow as growth in the number of beneficiaries increases at a faster pace than workers contributing to the program.

It’s a thorny issue, for sure, and is likely to be a central factor in negotiations for a solution to the long-term problem facing Social Security. Stay tuned as the 119th Congress turns it attention to this problem–a problem that has been developing for decades.