Re-thinking the COLA Process - AMAC Foundation

Two recent posts in the Social Security section of the Association of Mature American Citizens (AMAC) daily Newsline service provided readers with a recap of Social Security’s 2026 cost-of-living adjustment (COLA). The articles explained the process for determining the adjustment, and both included comments on its inability to stem the loss of purchasing power facing America’s seniors. With a substantial portion of this population segment already living in poverty, it becomes clear that the current COLA process needs to be re-examined.

And with Social Security’s steadily eroding financial situation in play, it becomes clear that many changes will be needed to balance the scales for current and future beneficiaries. The COLA process is but one area that will no doubt be examined closely.

The COLA Calculation Process Today

The COLA is based on the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W), a Bureau of Labor Statistics measure that tracks changes in the cost of goods and services purchased by workers. Although CPI-W is calculated monthly, Social Security only uses the figures from July, August, and September to determine the next year’s adjustment.

The agency averages those three months’ data and compares it to the same period from the previous year. If the number is higher, the percentage increase becomes the new COLA. If the current year’s figure is lower, the COLA is set at zero—since benefits cannot decrease. This has happened three times in recent memory: 2010, 2011, and 2016.

How the COLA is Applied, and a Potential Change

Social Security currently applies the annual cost-of-living adjustment (COLA) on an equal percentage basis. Average yearly calculations for the 2000 to 2025 period were 2.6%, although there were four years in which the adjustment was 0% or less than 1%. During this period, the costs faced by seniors have outpaced benefits substantially, leading to a 36% loss of purchasing power as reported last year by The Senior Citizen League (TSCL).[1]

To help reinforce Social Security’s mission as an anti-poverty program, adopting an equal-dollar approach to the COLA calculation based on the average retirement benefit could be considered. This approach would shift more of the COLA to lower-income beneficiaries, thus increasing their buying power. Here’s how it would work:

- Each October, the calculated inflation factor would be applied to the average benefit for each beneficiary category (i.e., Retired Workers, Survivors, Disabled Workers, etc.).

- The dollar value from this average calculation would be applied to each beneficiary’s monthly amount.

- Lower-dollar beneficiaries would receive a higher percentage adjustment, and higher-dollar beneficiaries would receive a lower percentage adjustment.

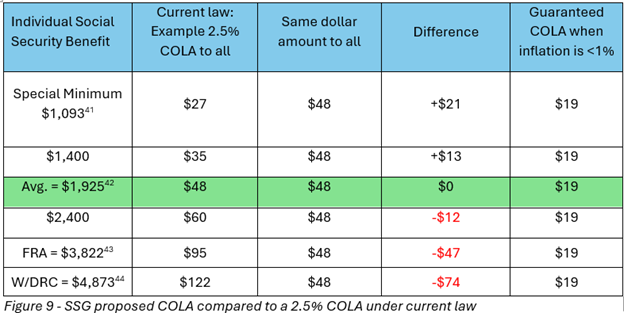

This chart illustrates, using hypothetical figures and a 2.5% COLA calculation, what the impact of a change of this type would be for various benefit levels:

The net effect of this change in how COLAs are applied would be to shift a portion of the dollars associated with the annual adjustment to lower-benefit recipients. As such, it is consistent with Social Security’s primary purpose of keeping seniors out of poverty. The fiscal impact of this change would be relatively small, since the number of beneficiaries below the median benefit distribution is about equal to those above it. The additional dollars flowing to low earners should roughly offset the dollars taken away from the higher earners.

Note also that this hypothetical illustration addresses only the Social Security benefit calculation; it does not reflect the impact of Medicare Part B premium adjustments on the net monthly amount beneficiaries receive.

Congress has Seen Many COLA-related Proposals

Although Congress has yet to take action on changes to address Social Security’s long-term funding deficit, many proposals have been submitted for evaluation by Social Security’s Actuaries. The Actuarial Service’s page on the SSA.gov website lists nine recent proposals that have been evaluated, ranging from reductions in the calculated percentage to increases in the percentages for those reaching age 65 and beyond. As noted earlier, the COLA process is just one area that will likely come under scrutiny as the search continues to better preserve and modernize Social Security to meet the demands of 21st-century economics.

[1] https://seniorsleague.org/assets/LOBP-Study-2023.pdf