Latest News

Social Security’s “Do Over” Options (They’re Not Secrets, Just Not Well Known)

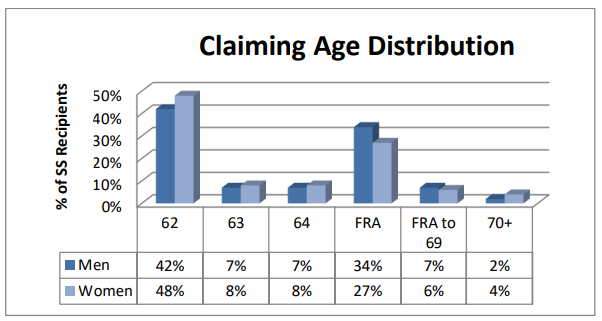

Statistically, 42% of men and 48% of women claim their Social Security benefits at age 62, the earliest age to claim retirement benefits. Often, after taking this step, these folks realize that it may have been better to wait until their full retirement age or beyond to get a larger monthly benefit. This realization can cause chagrin, but what they may not understand is that there are two options available to them to recover some of the forfeited benefits. The Motley Fool’s Trevor Jennewine, in a post today on their website, provides an explanation of the two options: a first-year complete do-over option, and an option to suspend benefit payments after reaching full retirement age and capitalizing on deferred retirement credits. Check his post out here…

By the way, about 57% of beneficiaries claim benefits before their FRA, while only about 10% wait beyond their FRA to claim. The graph below illustrates the beneficiary claiming patterns: