When to Apply for Social Security Spouse Benefits - AMAC Foundation

Here at the AMAC Foundation’s Social Security Advisory Service, we answer thousands of inquiries each year, largely focused on when the questioner should claim their personal SS retirement benefit. And we usually say “it depends” – on each person’s individual circumstances. And it is often closely tied to the person’s life expectancy. After all, SS retirement benefits can be claimed at any time during an 8 year window (between age 62 and age 70), and benefits claimed at age 70 are about 75% more than if claimed at 62. Of course, financial need is usually also a primary factor. But, for married couples, what is far too often neglected is the SS benefit a spouse may be entitled to. Which is why we always suggest that each couple evaluate their claiming options considering their spousal benefit as well as their SS retirement benefit.

First understand how spouse benefits work

A spouse can get benefits on their marital partner’s SS record if the spouse’s personal SS benefit (at the spouse’s full retirement age) from working, is less than 50% of their marital partner’s full retirement age (FRA) benefit amount. And that also includes a spouse who isn’t eligible for their own SS retirement benefit, often the case when, for example, one spouse mainly runs the household and raises their children while the other pursues a career. In that case, one spouse may have no earned SS benefit from working but can still get spouse benefits based upon their marital partner’s SS earnings record. So, any spouse – even those not entitled to their own SS benefit – can get benefits from their marital partner, provided their own earned SS benefit is less than half of their partner’s SS benefit at full retirement age. But the question is – when and why should the spouse claim their spousal benefit?

When can spouse benefits be claimed?

In most circumstances,[1] the spousal benefit can be claimed at any time after reaching age 62, provided the spouse’s marital partner has also claimed Social Security retirement benefits. In other words, both spouses must be collecting benefits. The spouse, however, usually has options for when to claim their spouse benefit. You see, spouse benefits do not reach their maximum amount until the spouse has reached their own full retirement age (FRA); if claimed before FRA, the monthly amount will be permanently reduced. But waiting beyond FRA does not enhance the spouse’s payment amount. Thus, we usually recommend that spouse benefits always be taken at or before the spouse’s full retirement age. Note again, however, that both partners must be receiving SS benefits for spouse benefits to be paid. In other words, if the spouse’s marital partner isn’t yet receiving SS retirement benefits,[2] the spouse benefit cannot yet be claimed. But the point is, whenever possible, a spousal benefit (if the spouse is eligible for it) should not be claimed any later than the spouse’s full retirement age.[3]

The Role of Life Expectancy

Life expectancy is important when deciding when to claim all benefits, spouse benefits included. That’s because benefits taken earlier than full retirement age (FRA) are always reduced – in the case of spouse benefits, the reduction is about .694% for each month up to 36 months earlier than FRA, and another .417% for each month over 36 months early. So, a spouse claiming benefits at age 62 might get only about 32.5% of their marital partner’s FRA benefit amount, rather than the 50% they would get by waiting until their FRA to claim spousal benefits. Whether claiming early is wise depends on the spouse’s life expectancy – if they live beyond the age at which they will recover benefits forfeited if claimed earlier, then waiting longer to claim might be prudent. But if they die before breaking even, it would have been better to have claimed earlier.

Of course, no one knows how long they will live, but it is possible to make an educated guess. A look at one’s family history gives some insight, and current health and lifestyle are important too. The Social Security website has a life expectancy calculator (see this), and there is an even more robust calculator available at our AMAC Foundation website here.

As a general rule, a spouse who claims a spousal benefit 3 years earlier than their FRA will experience a reduction of about 25% to their spousal payment. FYI, Social Security also has an online calculator here which can assist with this mathematical exercise, but the spouse will need to know their own Primary Insurance Amount (PIA) and also their marital partner’s PIA to use this tool.[4]

At the AMAC Foundation’s Social Security Advisor Service, we usually suggest that If one partner’s benefit as a spouse is significantly more than their own SS retirement amount, and if they expect only average longevity (or less), then it is sometimes wise to claim the spousal benefit even before FRA, provided the spouse is not working (and thus subject to Social Security’s Annual Earnings Test prior to FRA). But maximizing the spousal benefit if the spouse expects a high life expectancy can be best achieved by claiming the spouse benefit at the spouse’s full retirement age.

When Both Spouses Have SS Retirement Benefits

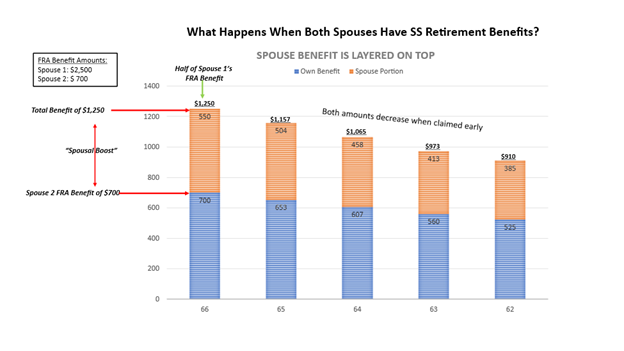

The considerations are somewhat different if both spouses are entitled to their own SS retirement benefit, with the lower earning spouse also entitled to a “spousal boost” on top of their own SS retirement amount. Social Security always pays ones personally earned SS retirement amount first, supplemented by an additional amount to make the payment equal what is due as a spouse. For example, if a spouse is entitled to SS retirement on their own work record, they will always get that amount first, and the spousal portion of their total benefit will be added on top of the spouse’s own earned amount. But, as previously stated, all SS benefits taken early (before FRA) are reduced, which means that someone who claims SS before FRA will (if they are also eligible for a spousal benefit), see only one payment which represents both their own earned SS retirement amount and their “spousal boost.” This is best illustrated as follows:

So, when should a spouse claim benefits?

Well, as stated above, “it depends.” Life expectancy, financial need, and plans for working all come into play when deciding when a spouse should claim their benefits. A spouse cannot claim a spousal benefit until their marital partner is already collecting SS retirement benefits, and the partner’s SS retirement amount at FRA must be at least twice the amount the spouse is entitled to at FRA. But for a spouse who has, indeed, determined that they are eligible for spouse benefits (e.g., a “spousal boost” to their personal SS retirement amount), it may be helpful to use a “Flow Diagram” to do the evaluation, such as in the chart below. In this diagram, the spouse can start at the top box and answer questions in the “decision” (diamond-shaped) boxes below, following the diagram path to a conclusion and gain insight into whether it would be wise to claim spousal benefits early or wait until their full retirement age to claim.

Note in the lower “decision” (diamond-shaped) boxes that the survivor benefits from the marital partner are also a consideration. That’s because surviving spouse benefits are more than normal spousal benefits[5], so the probability of the spouse becoming a widow(er) should be evaluated. If the spouse eventually will receive a higher survivor benefit, it is usually best to claim the normal spousal benefit earlier.

Where to get help

If this all seems complicated, that’s because it truly is. There are also other factors that may affect a spouse’s claiming decision, including if minor or disabled adult children are in the picture. But in any case, the AMAC Foundation’s Social Security Advisory Service is always available to assist spouses (and others) reach a decision on when it is best to claim their Social Security benefit. All AMAC Foundation services are free (we are a non-profit company), and all questions are answered promptly and completely – either over the phone (1.888.750.2622) or via email (SSadvisor@amacfoundation.org).

This article is intended for information purposes only and does not represent legal or financial guidance. It presents the opinions and interpretations of the AMAC Foundation’s staff, trained and accredited by the National Social Security Association (NSSA). NSSA and the AMAC Foundation and its staff are not affiliated with or endorsed by the Social Security Administration or any other governmental entity. To submit a question, visit our website (amacfoundation.org/programs/social-security-advisory) or email us at ssadvisor@amacfoundation.org.

[1] A spouse may be able to claim benefits earlier if caring for the couple’s minor children.

[2] Possibly because the marital partner is delaying past FRA to get a higher SS retirement benefit, or are too young to claim SS retirement benefits.

[3] Full retirement age (FRA) is somewhere between age 66 and 67, depending on year of birth.

[4] ‘PIA or Primary Insurance Amount is the SS retirement benefit each person is entitled to in the month they attain full retirement age.

[5] A surviving spouse who has achieved FRA receives 100% of the benefit their deceased partner was receiving at death, rather than the maximum 50% of their partner’s FRA amount while both are living.

Pingback: When to Apply for Social Security Spouse Benefits | AMAC