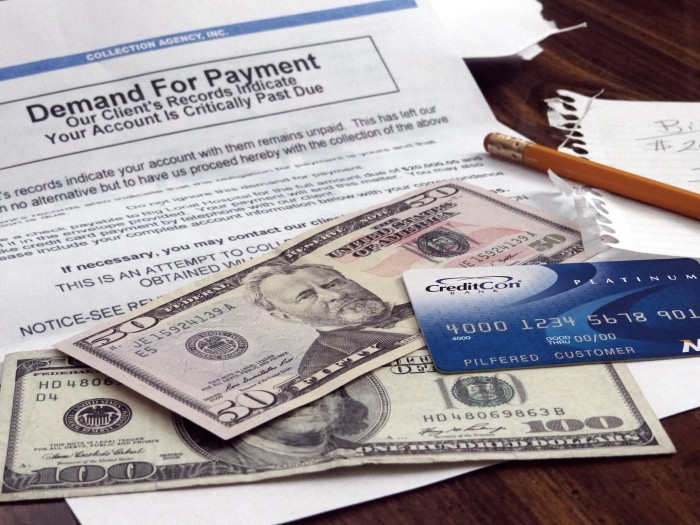

Retiring with Debt

Acquiring debt has come to be the new great American pastime. Baby Boomers are entering in to retirement riddled with debt which has negatively impacted their savings while they were working. Only 23% of current retirees are debt free, leaving a staggering three quarters of retirees in debt while living on a fixed income. Most can’t afford this, and it has pushed the average retirement age higher in recent years. The debt that they accumulated in their younger years has left Boomers waiting until the last minute to start saving for retirement, an insurmountable task that most won’t achieve. For more information on this topic visit this article by Mary Beth Franklin with Investment News.