The Retirement Age Debate: Battle Lines are Continuing to be Drawn - RSC; AMAC et. al

In the days since last week’s release of the Republican Study Committee’s (RSC) Fiscal Year 2025 Budget proposal–titled “Fiscal Sanity to Save America”–the airwaves have been alive with commentary on the future of Social Security. One of the more significant aspects of the RSC proposal is the recognition that “Congress has a moral and practical obligation to address the problems with Social Security” and, while this is not a revelation in and of itself, it is refreshing to see it officially recognized in a concrete budget proposal.

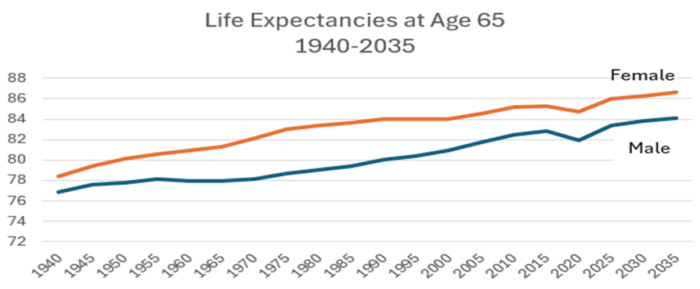

Much of the media commentary is focused on the RSC statement: “(The proposal) would also make modest adjustments to the retirement age for future retirees to account for increases in life expectancy.” The financial calamity facing Social Security–the full depletion of Social Security’s trust fund cash reserves less than ten years from now–can be attributed to several key factors, one of which is the length of time benefits need to be paid to beneficiaries. For example, since 1940 life expectancy for those reaching age 65 has grown substantially, increasing by 10.5% for females and 9.3% for males.

Source – 2023 Social Security Trustees Report, Table VA4.

The RSC proposal calls for delayed implementation of the recommended retirement change to protect seniors in or near retirement while helping, along with other program adjustments, to put Social Security on a more solid footing for the future and avoid the benefit cuts that would result from taking no action.

Newly installed Social Security Commissioner Martin O’Malley has expressed concerns regarding the retirement age change, as reported in an article by Juliana Kaplan and Ayelet today on Business Insider India. Likewise, MSNBC Opinion Editor James Downie dubbed the proposal “the biggest possible gift” from the RSC to President Biden’s re-election campaign. Click here for the Business Insider article, and here for the MSNBC post.

The full text of the RSC proposal, which you can read here, recaps what has been a common theme for some time regarding what to do about Social security. The report discusses three general policy options likely to be debated in the months and years ahead as the search for a solution unfolds: funding transfers from the general fund, tax increases, and program savings necessitated by the program’s current unsustainable design.

As an example of the leading thoughts on reforming Social Security, the Association of Mature American Citizens (AMAC, Inc.) believes preservation and modernization can be achieved via slight modifications to cost-of-living adjustments and payments to high-income beneficiaries plus gradually increasing the full (but not early) retirement age. AMAC Action, AMAC’s advocacy arm, supports an increase in the thresholds where benefits are taxed and then indexing the thresholds for inflation and calls for eliminating the reduction in people’s benefits for those choosing to work before full retirement age. AMAC is resolute in its mission that Social Security be preserved for current and successive generations and has gotten the attention of lawmakers in D.C., meeting with many congressional offices and staff over the past decade. Learn more about AMAC’s plan to address the Social Security financial crisis here.