The Social Security Solvency Dilemma – Part 2

Social Security: The Projected Depletion of Reserves

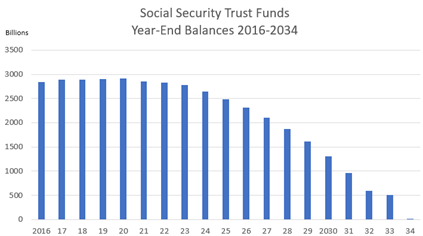

The most recent Social Security Trustees Report projects that the Old Age and Survivors (OASI) Trust Fund will be fully depleted by 2033. When combined with the Disability Insurance (DI) Trust Fund reserves, the hypothetical depletion date for the full Social Security program slips to 2034. Either way, the realization of full Trust Fund depletion would require the program to rely solely on incoming tax revenue, dictating a reduction in scheduled benefit payments of at least 20%.

The Congressional Budget Office, in its 2022 Long-Term Budget Outlook, sets the proximity of this Trust Fund depletion closer, projecting the combined Trust Funds to be exhausted by 2033, with a benefit reduction of about 25%.[i] But no matter which projection one uses, we’re on a trajectory for a harsh situation in about a decade unless corrective legislative action is taken.

As a matter of law, all revenue flowing into Social Security is received by the U.S. Treasury and immediately converted into special interest bonds. These bonds are then held by Social Security in the program’s trust funds, redeemed as necessary to pay benefits. Excess revenue over disbursements adds to the trust funds’ reserve balances, while excess disbursements over revenue reduce balances.

Historically, the old-age and survivors insurance (OASI) trust fund was established at the beginning of 1940, pursuant to the Social Security Act Amendments of 1939 and coincident with the start-up of monthly benefit payments from the program. At the end of the first fiscal year (ending June 30, 1940), the OASI trust fund had a recorded balance of $1,745 billion; this reserve balance grew steadily from 1940 through 1957, the year the disability insurance (DI) trust fund was established, and had accumulated over $23 billion at that point. At the end of fiscal year 1957, the DI trust fund balance was $337 million, with the combined OASDI balance then standing at $23.366 billion. The combined trust fund balance, despite yearly fluctuations, grew from that point until 1982, reaching a cash reserve level of over $27 billion.

The 1983 Trustees Report contained this statement: “Without corrective legislation in the very near future, the Old-Age and Survivors Insurance Trust Fund will be unable to make benefit payments on time beginning no later than July 1983.” This led to the Social Security Amendments of 1983, through which the combined trust funds were restored with the projection that “the program will be able to pay benefits on time for the next 75 years under all but the most pessimistic” assumptions.[ii] These amendments, which primarily included setbacks in full retirement age and the initial levy of federal income tax on benefits for certain taxpayers, enabled the combined trust fund reserves to resume their growth, reaching a high of $2.9 trillion by year-end 2020.

Now, as of fiscal year 2021, the trust funds’ total income (payroll tax, interest, and federal income tax on benefits) is insufficient to cover scheduled benefits, requiring the redemption of the bonds held in reserve. As noted above, the reserve balance is on a pathway to depletion at this point, since incoming revenue is projected to remain insufficient to cover scheduled benefits in the years ahead.

[i] https://www.cbo.gov/system/files/2022-07/57971-LTBO.pdf (page 18)

[ii] https://www.ssa.gov/OACT/tr/historical/1983TR.pdf